Although the multinational US tech giant has informed its 4,500 staff in the UK they will be working from home until at least summer 2021, Google has reportedly committed to leasing an additional 70,000 sq. ft. in office space in London, located near its new £1bn UK headquarters.

Currently under construction, the new HQ, dubbed the ‘landscraper’, is 330-metre-long and is centrally located next to King’s Cross railway station. Eleven storeys high, the building has capacity for 4,000 staff, is topped with a roof garden, features a swimming pool, basketball court and nap pods. In addition to the new lease near the ‘landscraper’, Google has also committed to extend a lease by ten years at the Central Saint Giles development near Tottenham Court Road.

Google’s commitment to office space in London comes at a time when many companies are looking to reduce their current office space. Chief Executive, Sundar Pichai, confirmed the company would focus on a hybrid model, encompassing both office and remote working, commenting: “We firmly believe that in-person, being together, having that sense of community is super important for whenever you have to solve hard problems, you have to create something new. We don’t see that changing. So, we don’t think the future is 100% remote, we definitely value our offices, we value the culture, but we do think we need to create more flexibility, a more hybrid model.”

Although hotel investment volumes in the UK are dominated by London, recent research from Savills highlights that total deal count outside the capital has risen markedly since lockdown measures eased earlier in the year.

Aligned with healthy trading performance across staycation markets, over three quarters (77%) of deals made since April were outside London, with private investor interest for rural and coastal hotels soaring. Investors are focused on well-located properties with the potential for development, to increase their longer-term income profile.

Director in the hotel investment team at Savills, Tom Cunningham, commented: “With restrictions limiting international travel as a result of COVID-19, we experienced a boom in domestic travel and staycations… The likelihood of ongoing restrictions into 2021 has meant that holidaymakers are continuing to look to the domestic market for their breaks… As a result, we expect robust operational performance in these locations to continue with well-situated regional assets continuing to attract strong investor demand. For regional assets currently on the market, we are receiving multiple offers above guide price.”

The UK’s beleaguered leisure industry took another blow with the recent announcement of the nationwide closure of Cineworld’s theatres, the country’s largest cinema operator. The closure results in the loss of 5,500 jobs and threatens many more working in neighbouring restaurants, dependent on the multiplex trade.

Ross Kirton, Head of UK Leisure at Colliers International commented it’s: “not a great time” to be the landlord of a leisure scheme. He added: “Box office admissions in January were 16.5m people, whereas the figure for August was 2.5m. It’s about the sheer volume of people and the ‘dwell time’ cinemas create. The impact on a restaurant of a cinema closing is only going to be negative.”

Ronald Nyakairu, an analyst at Local Data Company, suggests repurposing space to logistics firms in need of warehouse space to serve the online shopping industry, would be one way to utilise leisure parks, he warned: “Historic data shows that units that fail to find a new tenant after two years are likely to never be re-let. Leisure parks will need to reinvent themselves if they are to survive.”

Source: Zoopla, data extracted 22 October 2020

| Region | No. properties | AVG. asking price |

|---|---|---|

| London | 1,249 | £1,186,253 |

| South East England | 1,288 | £641,725 |

| East Midlands | 865 | £545,468 |

| East of England | 765 | £491,716 |

| North East England | 954 | £322,632 |

| North West England | 1,780 | £418,537 |

| South West England | 1,808 | £650,046 |

| West Midlands | 1,243 | £601,322 |

| Yorkshire and The Humber | 1,354 | £365,469 |

| Isle of Man | 53 | £472,912 |

| Scotland | 1,332 | £310,437 |

| Wales | 810 | £383,488 |

| Northern Ireland | 32 | £426,678 |

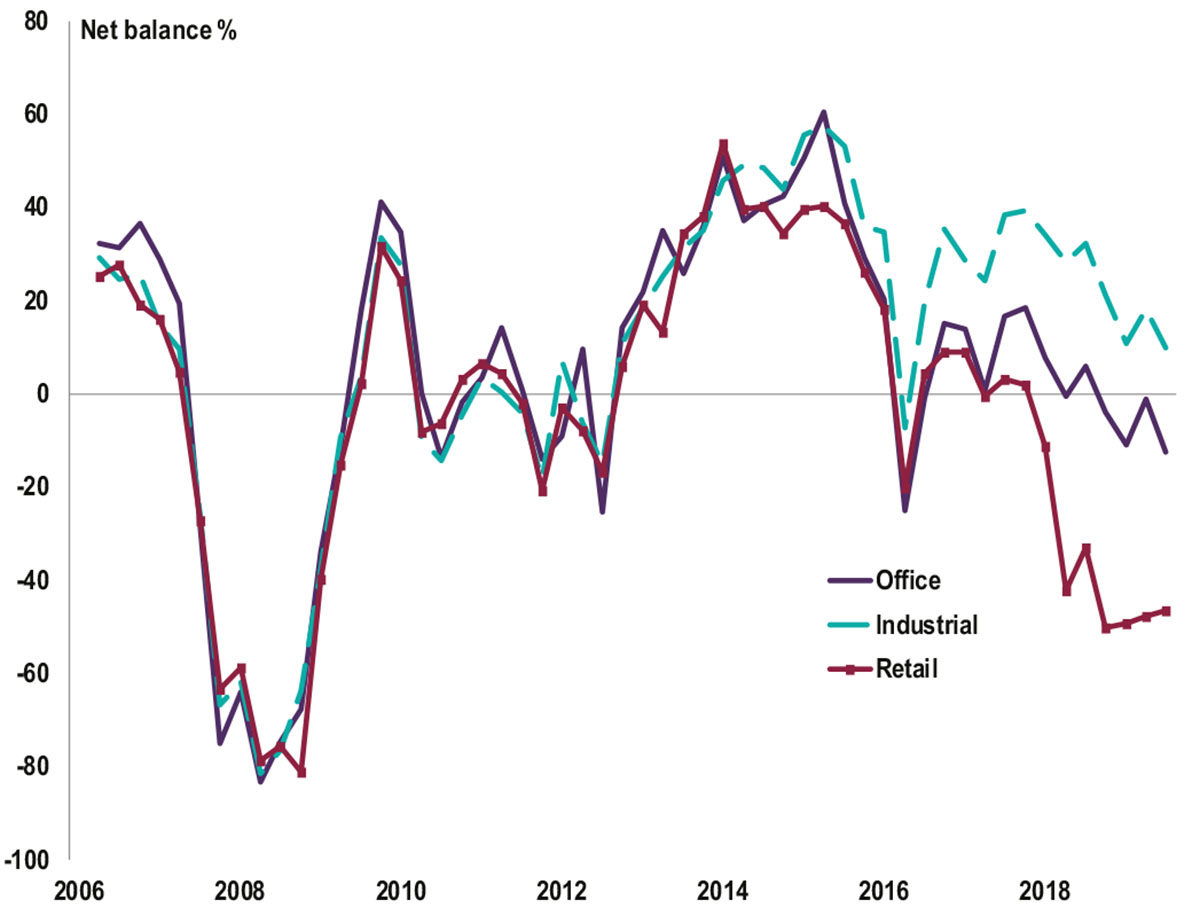

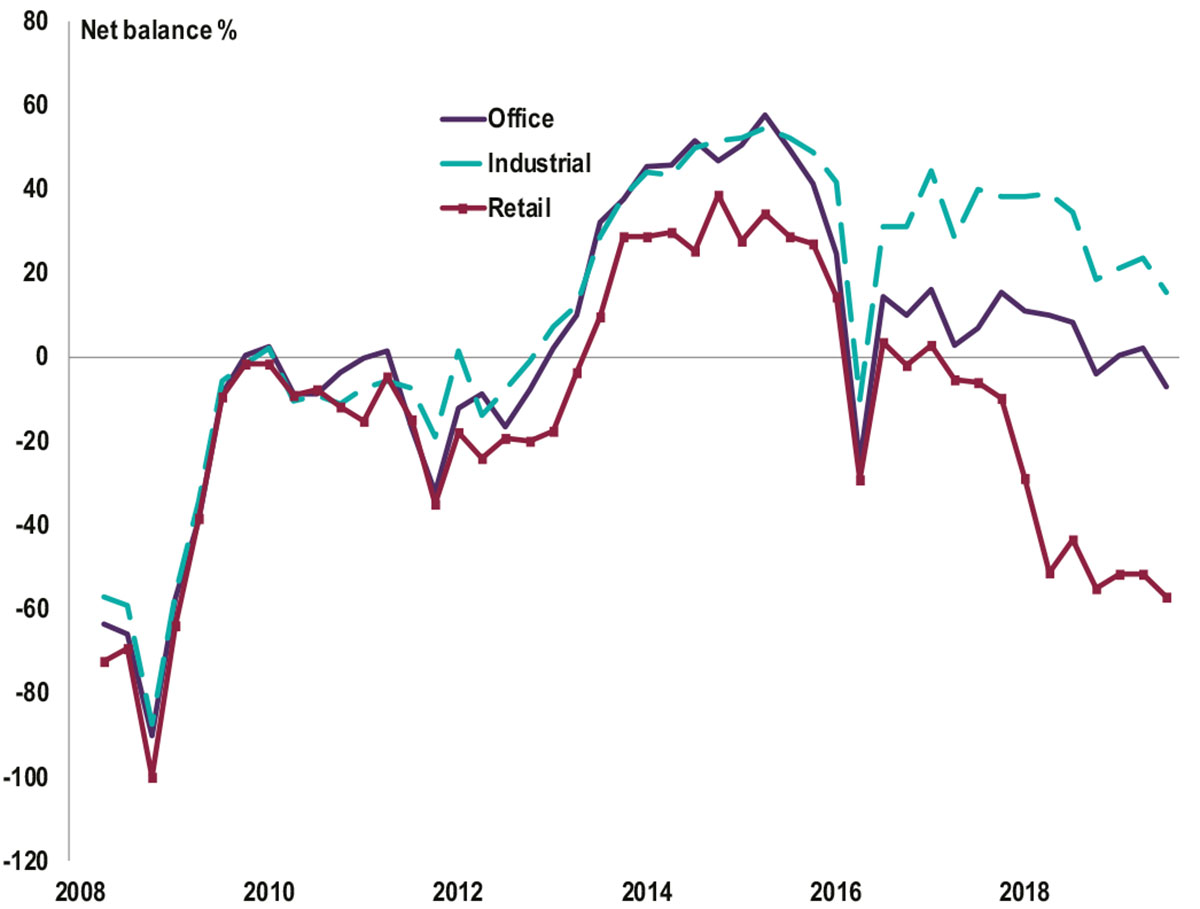

Source: RICS, UK Commercial Property Market Survey, Q3 2020

All details are correct at the time of writing (22 October 2020)

It is important to take professional advice before making any decision relating to your personal finances. Information within this

document is based on our current understanding and can be subject to change without notice and the accuracy and completeness of

the information cannot be guaranteed. It does not provide individual tailored investment advice and is for guidance only. Some rules

may vary in different parts of the UK. We cannot assume legal liability for any errors or omissions it might contain. Levels and bases of,

and reliefs from, taxation are those currently applying or proposed and are subject to change; their value depends on the individual

circumstances of the investor. No part of this document may be reproduced in any manner without prior permission.